NADA can be accurate . . . or not.

I have found NADA to be more reflective of a depreciation curve than a market assessment. There is some market input, but not all that much . . . so it seems.

Try bucvalu.com as a second source (I think you can get a free membership which allows 3 price checks every 3 months.)

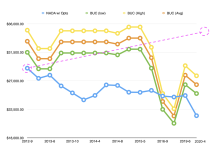

FWIW - on my previous boat, ( a Formula 330 SS) which I owned for 9 years, I tracked the 'market value' listings on NADA and BUC every year or so and kept the data in a chart. see below . . .

View attachment 374035

The blue line is NADA and the 3 similar lines are Bucvalue figures for high, mid, and low.

The pink line is what I bought and sold the boat for . . . over the 9 year span. Not much of a correlation . . .

NADA tended to be lower and show a more steady decline in value as the boat aged. None of the pricing models seemed to be able to keep up with pricing in the past 2 years.

NADA tends to be lower on older boats and higher on newer boats.

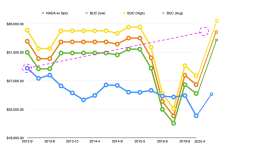

The current values (2022) of 'my' boat (even though I don't own it any more) are. . .

NADA = $24,000 (avg retail)

BUC = $33,700 - 37,400 (range)

The BUC figures are more 'accurate' as to what the boat sold for last year.

EDIT: here is an updated chart

View attachment 374036

So, NADA is just one data point and you probably need some other comparisons to see if it is high or low vs. what a typical selling price would be for the boat you are interested in.