I know a boat can be considered a residence if it contains a toilet and sink for the purpose of deducting interest paid if it is in the form of a mortgage. I do plan to use the boat (19 ft Polar center console) to take business associates out for a few hours fishing on a regular basis and believe it would justify expensing a portion of the boats operational expenses for business use. Also wondering if there is any benefit or disadvantage of buying the boat as a business transaction rather than a personal transaction? I know guys who deduct several thousand dollars of country club fees and don't see where this is much different. I have not run this by my accountant yet but thought some folks here may have some helpful input based on your experiences.<br /><br />Helpful advice appreciated.<br />Kevin

- Shop

-

Main Menu Find The Right Fit

-

-

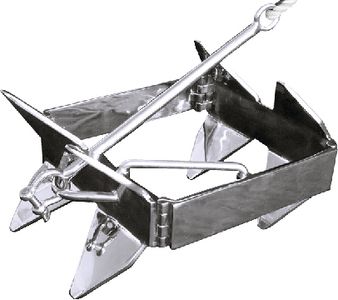

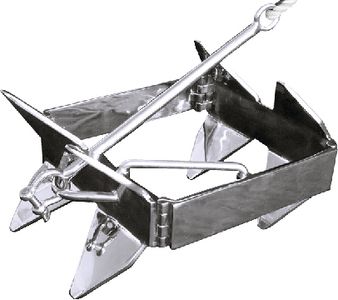

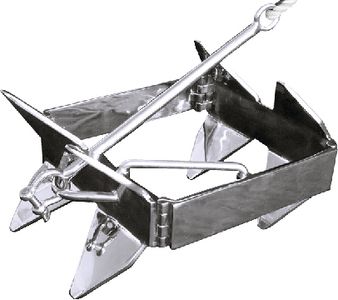

Slide Anchor Box Anchors Shop Now

-

Back Fishing

-

View All

- Fishing Rods

- Fishing Reels

- Fishing Rod & Reel Combos

- Fishing Tools & Tackle Boxes

- Fishing Line

- Fly Fishing

- Fishing Bait & Fishing Lures

- Fishing Rod Holders & Storage Racks

- Fish Finders, Sounders & Sonar

- Trolling Motors

- Fishing Nets

- Fishing Downriggers & Acessories

- Fishing Outriggers & Acessories

- Fishing Kayaks

- Fish Cleaning Tables

-

-

Minn Kota Riptide Terrova 80 Trolling Motor w/i-Pilot & Bluetooth Shop Trolling Motors

-

SportsStuff Great Big Marble Shop Tubes

-

Big Jon Honda 5hp Outboard Shop Outboards

-

Lexington High Back Reclining Helm Seat Shop Helm Seats

-

Kuuma Stow n Go BBQ Shop Now

-

Slide Anchor Box Anchors Shop Now

-

Back Electrical

-

View All

- Boat Wiring & Cable

- Marine Batteries & Accessories

- Marine DC Power Plugs & Sockets

- Marine Electrical Meters

- Boat Lights

- Marine Electrical Panels & Circuit Breakers

- Power Packs & Jump Starters

- Marine Solar Power Accessories

- Marine Electrical Terminals

- Marine Fuse Blocks & Terminal Blocks

- Marine Switches

- Shore Power & AC Distribution

-

-

ProMariner ProNautic Battery Charger Shop Marine Battery Chargers

-

Lowrance Hook2-4 GPS Bullet Skimmer Shop GPS Chartplotter and Fish Finder Combo

-

Boston Whaler, 1972-1993, Boat Gel Coat - Spectrum Color Find your boats Gel Coat Match

-

Rule 1500 GPH Automatic Bilge Pump Shop Bilge Pumps

-

Back Trailering

-

SeaSense Trailer Winch Shop Trailer Winches

-

Seadog Stainless Steel Cup Holder Shop Drink Holders

-

Slide Anchor Box Anchors Shop Now

-

- Boats for Sale

- Community

-