Re: Insurance Boat Value

Never even thought about mechanical coverage here. You mean you can ignore maintenance and the insurance company replaces stuff for you as it is destroyed? Make a quick run through the low water over the sandbar every couple of years to take out the impellor and get a new engine? Loosen up the oil screw in the outdrive, ride around for a couple of hours and they give you a new one? Maybe just go to WOT in neutral and see how long it takes to throw a rod through the block!

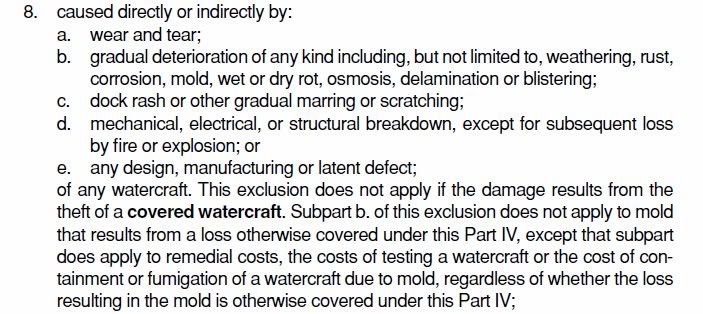

I'd be interested in seeing the actual language of a policy that covers that and how much it is...

There is no such thing as a "mechanical coverage" policy, of course. I know you know that. The exclusion section you listed is a good one, and that pretty much throws out all things limited to mechanical failure.

It's a claim by claim thing, of course.

Back to the original topic, the value. While our friendly agent above pointed out that insurance is meant to compensate you for what you had (indemnity), there are "yacht" policies out there, sold by companies that will list the Agreed Value at just about whatever number you put on it. At the company I used to work for, we even made a whole business plan (at a training seminar, as a joke) where we were going to by $1000 boats, insure them for $10,000 each, with our own company, and then "accidently" burn them up in a storage building. We were able to show that would would make a huge profit. Yet noone at our company ever changed the underwriting rules for our policy.

So my official advice is, if you can find a company that will agree to insure insure a $5000 boat for $15000 and the premium is not outrageous, DO IT! Just be prepared that if you do $7000 worth of damage to the boat, they won't "total" it, they'll pay the $7000 worth of repair (after all they have up to $15000 to spend) and you'll be left with a junk boat that you now have to part out and dispose of. Small price to pay though, don't you think?

I will gladly provide the name to the company I used to work for in a PM if any of you are serious. They are a good company, it's a good policy, and the premiums are lower than most. They write mostly east of the Mississippi, the Midwest, but not New England, Florida, and most places west of Iowa.